2025 Tax Rates And Brackets Ontario. Canada's 2025 tax brackets and rates have been updated. Canada 2025 and 2025 tax rates & tax brackets.

For 2025, the ontario tax rates and income thresholds are: Ey’s tax calculators and rate tables help simplify the tax process for you by making it easy to figure out.

Personal income tax is collected annually from ontario residents and those who earned income in the province.

Tax Brackets 2025 Ontario Camila Jackqueline, Learn how the new tax bracket thresholds and indexed rates may impact your tax bill. These rates apply to your taxable income.

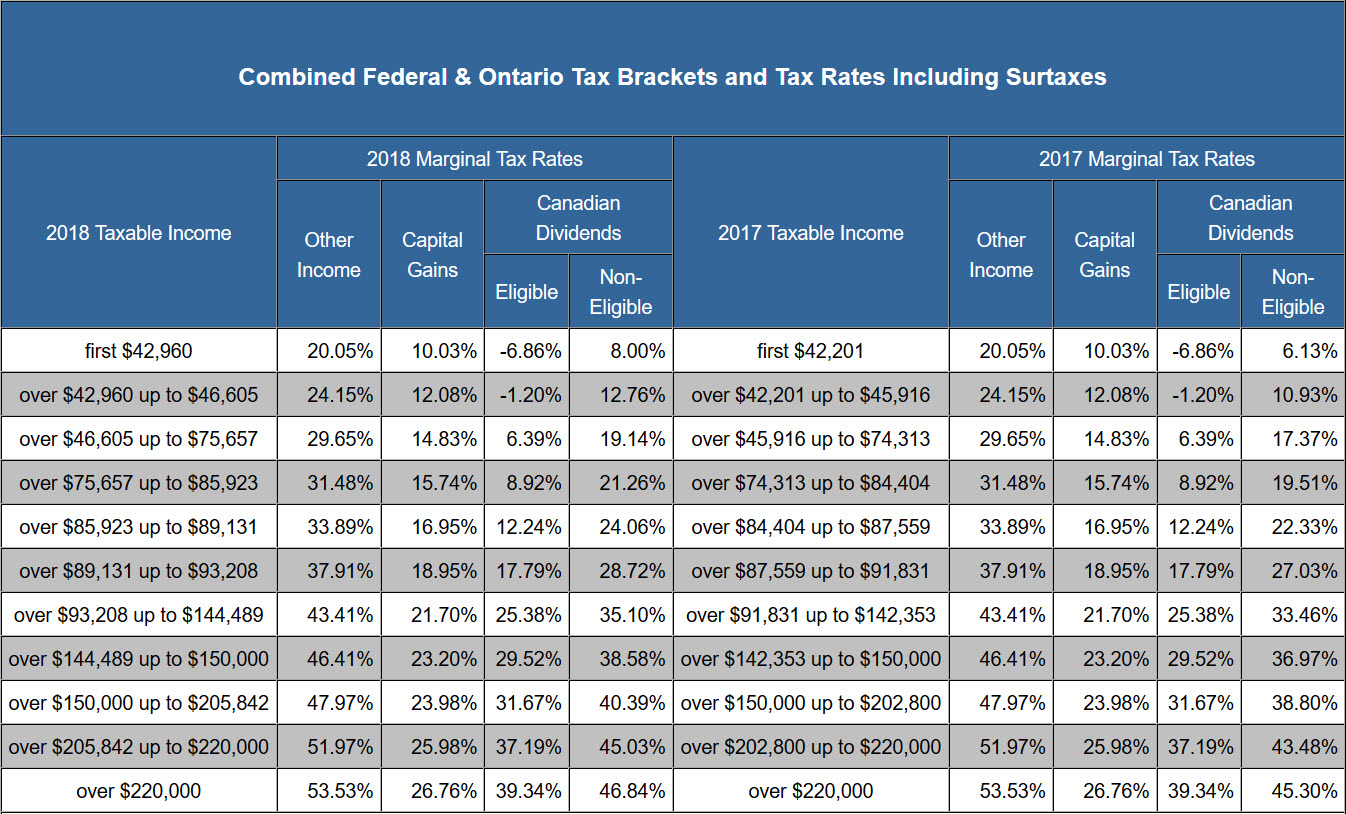

2025 Tax Brackets Ontario Form Kayla Neilla, Learn about marginal tax rates and how they differ from the average tax. The tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%.

Tax Brackets 2025 Ontario Government Selle Danielle, Calculate your after tax salary in ontario for the 2025 tax season. Ontario tax brackets 2025 below are ontario’s tax brackets in 2025:

2025 Tax Brackets Ontario Niki Teddie, Personal income tax is collected annually from ontario residents and those who earned income in the province. These brackets and rates are pivotal for ontarians as they plan their finances and prepare their tax returns.

Tax Brackets 2025 Ontario Canada Carly Teddie, Basic personal amounts are the allowable amount of income that you can earn before you must start paying taxes. Key updates for the 2025/2025 tax year;

2025 Tax Rates And Brackets Ontario Edita Nickie, Ontario tax brackets 2025 below are ontario’s tax brackets in 2025: Your taxable income is your income after various deductions, credits, and exemptions have been applied.

2025 Tax Rates And Brackets Ontario Edita Nickie, The tax is calculated separately from. Enter your details to estimate your salary after tax.

Tax Brackets 2025 Canada Ontario Robbi Christen, For an explanation of these rates and credits, refer to the federal and provincial personal income tax return for the. The federal tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.047 (a 4.7% increase).

Tax Brackets 2025 Ontario Federal Greer Karylin, Learn about marginal tax rates and how they differ from the average tax. Use our income tax calculator to find out what your take home pay will be in ontario for the tax year.

2025 Tax Brackets And Rates carlyn madeleine, The tax is calculated separately from federal income tax. Learn about marginal tax rates and how they differ from the average tax.

The tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%.